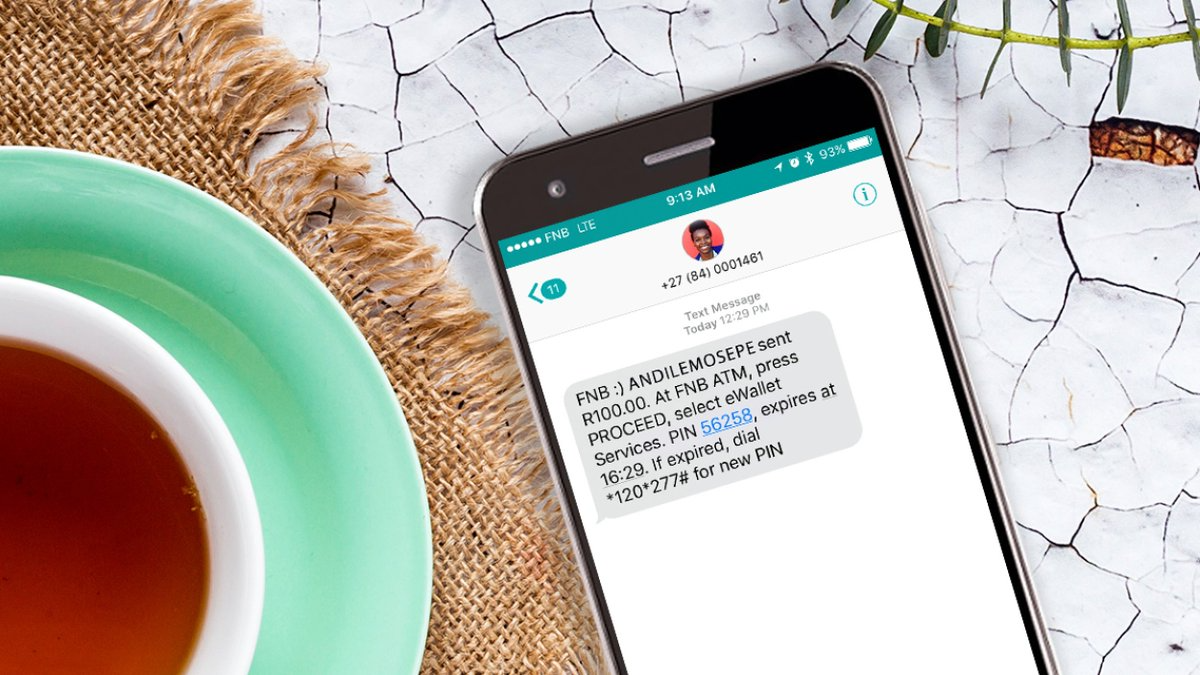

First National Bank’s (FNB) eWallet service has become a cornerstone of financial transactions for many South Africans. The service facilitates the instantaneous sending and receiving of money from one bank account to a mobile number within the country. But what recourse is available if one executes an incorrect transaction?

The Reversal Option

FNB provides a remedy for such situations through its eWallet reversal feature. This allows a user who has mistakenly sent money to the wrong recipient to reverse the transaction and recover the funds.

How to Execute an eWallet Reversal

Several pathways exist for executing an eWallet reversal with FNB, offering convenience and flexibility.

Contacting Customer Service

Upon realizing an erroneous transaction, a sense of urgency and stress may understandably emerge. Your first option is to reach out directly to FNB’s customer service to request a reversal.

- Complaints resolution telephone number: 087 575 9405 (Note: charges may apply)

- Customer care desk: 087 575 0362/ 087 575 0000

- Email address: care@fnb.co.za

While both phone calls and emails can be used, phone calls generally yield quicker results.

Utilizing the USSD Code Method

Another convenient approach is the use of FNB’s eWallet reversal USSD code. The steps are as follows:

- Dial 120321# on your mobile phone.

- Choose option 4 for “Send Money.”

- Next, select option 5 for “eWallet Reversal.”

- Follow the on-screen instructions to complete the reversal.

Using the FNB App

For those who prefer using the FNB mobile app, the process remains uncomplicated.

- Log into your FNB app.

- Navigate to your debit order account.

- Under “My Debit Orders,” select the transaction you wish to reverse.

- Choose the reason for the dispute.

- Confirm to accept the terms and conditions.

Timeframes for Reversals

It’s important to understand that the time it takes to process a reversal can vary. Generally, a reversal will take up to four business days to appear on your statement if initiated through the customer care center. For transactions sent to inactive numbers, the reversal process may take up to 15 business days.

Cost Implications

Reversing an eWallet transaction incurs a fee of R50. Furthermore, it’s crucial to note that FNB does not guarantee the success of every reversal, which makes double-checking transaction details crucial.

What to Do If You Receive an Unexpected Transfer

If you find that you have received money from an unknown sender, it’s advised not to withdraw the money. The FNB system will automatically revert the funds to the sender after the PIN expires.

Money Validity Periods Across Banks

For transactions involving other banks like Nedbank, Absa, and Standard Bank, the recipient must use a valid PIN within specific periods, ranging from seven to 30 days. After this, the money is reversed back to the sender’s account.

Key Takeaways for Successful eWallet Transactions

The convenience of FNB’s eWallet service extends to various platforms including mobile banking, ATMs, and online banking. To minimize the risk of needing a reversal, the following steps should be carefully executed:

- Choose the ‘Send Money’ option.

- Input the recipient’s mobile or bank account number and double-check for accuracy.

- Enter the amount you intend to send.

- Authenticate the transaction using your PIN.

Once completed, you’ll receive an instant message confirming that the money has been deposited into the recipient’s account or mobile number.

For those encountering issues with their eWallet service, customer care remains the first point of contact for resolution. It’s crucial to act quickly and diligently, taking all necessary steps to correct any errors and protect your financial interests.