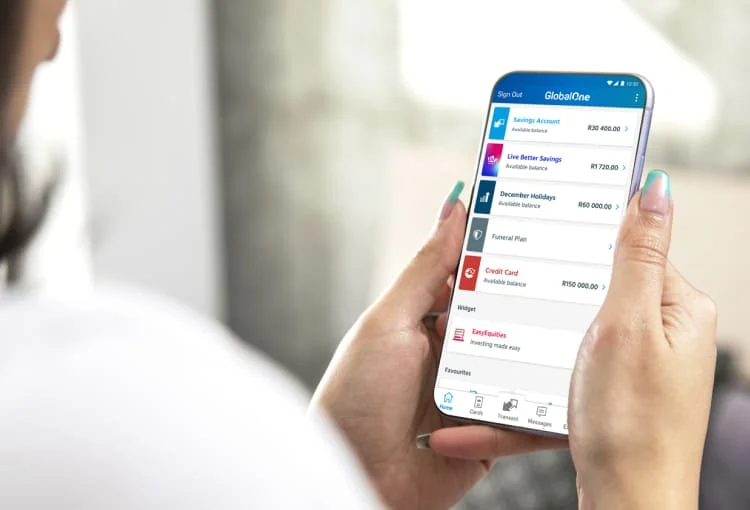

Capitec Bank has carved a niche for itself as a leading digital retail bank in South Africa, boasting over 18 million clients and an expansive network of branches nationwide. Through its Global One platform, Capitec aims to offer simplified, personalized, and affordable banking solutions. One such feature is the ability to reverse transactions, a need that sometimes arises due to honest mistakes or unauthorized access to an account.

The Relevance of Transaction Reversals

Transaction reversals are not unique to Capitec; they are a standard practice in various South African banking institutions. The growth of mobile banking applications has granted customers the flexibility to request refunds under unfortunate circumstances. With Capitec’s Global One mobile app, this process is made accessible to their vast clientele.

Steps to Reverse Money in the Capitec App

For those who may have erroneously sent money or suspect fraudulent activity on their accounts, the Capitec mobile app provides an avenue for reversal. Below are the steps to initiate this process:

- Open the Capitec Mobile Banking App.

- Select ‘transact’ from the available options.

- Click on ‘Debit Orders.’

- Enter your remote PIN.

- Choose the transaction you wish to reverse from your history.

- State your reason for the reversal.

- Accept the terms and conditions and then click ‘submit’.

Reversing an EFT Payment

Electronic Funds Transfers (EFTs) can also be reversed through the Capitec app. However, it should be noted that the bank urges caution with EFTs. Mistakenly transferred funds via EFT are not refundable, according to bank policies. If a transfer was conducted fraudulently, the process for reversal remains the same as that of standard transactions.

Limitations and Branch Assistance

It’s important to mention that reversing cash transfers using Capitec’s cellphone banking is not possible. The transaction details don’t appear in the mobile app, making it challenging to track and reverse. In such scenarios, customers can visit a nearby Capitec branch with their cash transfer receipt for assistance.

Time Constraints on Reversals

Disputed payments made within 40 days can generally be reversed in a few working days, provided they meet the bank’s set criteria. Requests made after this period may take longer to process.

Reversing Debit Orders

Capitec also allows the reversal of debit orders, albeit under stringent conditions. The bank makes it clear that disputing a valid debit order may result in adverse consequences, such as being handed over for bad debt or facing difficulty in entering into future agreements.

When Can Debit Orders Be Disputed?

The reasons for disputing debit orders include:

- Unauthorized use of your Capitec banking app

- Being billed multiple times for online purchases

- Payment errors

- Being misled into making a payment

Unavailable Options

For those seeking to reverse transactions that are neither debit orders nor EFTs, the Capitec app currently does not support such actions. Customers are advised to visit their nearest Capitec branches or reach out via the bank’s contact number 086 010 2043 for further assistance.

Vigilance Is Advised

Capitec emphasizes the importance of vigilance when dealing with transactions. The bank allows for reversals under specific conditions but advises customers to exercise caution, particularly with login details and when transferring funds.